✉️ Good Thought 7

Money, Our Strangest Abstraction

Welcome to Good Thought, a newsletter about fresh ideas for purposeful living in the 2020s.

I’m Aaron Nesmith-Beck. I founded Atman, one of the first legal psilocybin retreats, and my writing at Freedom & Fulfilment has over 1M pageviews. You can learn more about me here.

If you’re a new reader, you can subscribe below. You can unsubscribe at any time with the link at the bottom of the email.

You can read past issues of Good Thought here.

Money, Our Strangest Abstraction

The moneychanger and his wife by Marinus van Reymerswaele

Money is one of the strangest abstractions because it is both extremely objective and extremely subjective at the same time.

Money is objective

Dollars, pounds, yen, rupees, pesos, it doesn’t matter what we call it – money is a number, directly comparable to any other and divisible right down to the second decimal point. Exchange rates (with four decimal points!) allows us to compare across currencies, just as objectively. Anyone who knows basic math can tell you exactly how much more or less one money-number is than another, how many times it fits into another, etc.

Money is increasingly decoupled from the physical world, its value no longer tied to paper bank notes, let alone something like a gold coin. Money in modernity has become maximally abstract – most often just a number on a screen or inside someone’s head, as objective and precise as math itself.

Money is subjective

Money is subjective, in many ways.

- The same number can mean different things to different people (You vs. Elon Musk)

- The same number can mean different things to the same person at different points in time (You as a broke college student vs. You as a working professional)

- The same number can mean different things to the same person, at the same point in time, in different contexts (You buying something you’re price-sensitive to vs. You buying something you’re price-insensitive to)

What’s special about money?

You might be thinking, Hey, wait a minute, other things are both subjective and objective at the same time! This isn’t unique to money…

It’s true. Money is a precise and fungible abstraction, and other precise, fungible abstractions share this quality.

Units of measurement, for example. Height, length, width, distance, time, weight, temperature, are all both objective and subjective. A mile is a long way if you’ve just broken your leg, but not if you’re running a marathon. Ten minutes is a long time for a fourth-grader waiting for recess, and a very short one for someone sitting at the deathbed of their loved one. You get the idea.

But money is special. Why? At least two reasons, I think.

Perception of money is highly consequential

For better or for worse, money touches almost every single thing you do. Your time, possessions, skills, experience(s), all have monetary value. The gift and curse of money is that it can be used to value practically everything, and so it is. Therefore, what you think of money – how it seems to you – is highly consequential… to you.

Perception of money is mostly unconscious

Perceptions of money are mostly implicit and unconscious, inherited from parents, surroundings, upbringing, circumstances. There’s no standardization here, no one is taught this in school.

A friend of mine had a benchmark of a $400k/year salary in his head. Why that figure? Because it’s the most money his dad ever made. That seems like a lot to most people (including me!), but to him it seems realistic and pretty attainable.

Another friend and I used to joke that we were “rich” because we both like eating beans and rice (yes, just beans and rice, pour olive oil over it, it’s good) and we could effectively buy as much beans and rice as we wanted.

It’s silly because no rich person eats beans and rice every day. But the kernel of truth in the joke is that, for most people in developed countries, the cost of meeting this essential survival need is trivial. A few hours of labour, even at minimum wage, gets you a week’s worth of beans and rice. Almost all of us in the developed world are “rich” in this way.

Money and Class

One way that perception of money is both consequential and unconscious is the way it informs class.

I had an “aha” moment a little while back (or maybe it was a “duh” moment, it’s hard to tell the difference sometimes) when I realized that the reason the concept class consciousness exists is because class is mostly unconscious.

Imagine everyone is born wearing a pair of tinted, translucent glasses. You can’t really see your glasses because they’re so close to your face, and you’ve only ever seen the world through the tint of your glasses.

You sometimes get the sense that other people are wearing glasses, and maybe even that theirs have a different tint than your own, but you really have no idea what it’s like to look at the world through their glasses. I think class is probably a bit like this.

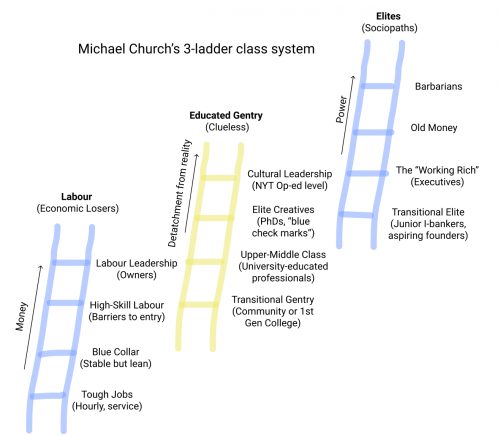

What do I mean by class? Well, the below image from this article (which I would highly recommend!) provides a pretty good sketch:

From “The Michael Scott Theory of Social Class” by Alex Danco

Class isn’t the same thing as money, but perception of money is an important part of class.

This is important for a very simple reason: it determines what people do. We spend a huge chunk of our lives on money-acquiring activity (your “career”), and for most people, this is driven by unconscious stuff (your perception of money, your class-tinted glasses, etc.) that is both a result of and creates further path dependence.

Two quick examples:

“Money from your laptop while you sit by the beach”

When I lived in Thailand, there were a lot of digital nomads trying to make a living online. (This was the mid-2010s, before everyone was making a living online.) In these circles, a business generating $2,000 – $3,000 USD per month was considered “pretty good”. This isn’t very much money in North America or Europe, but in Thailand it can go pretty far, and was seen as something worth aiming for. So these people spent their time and energy trying to build businesses that could plausibly make $2,000 – $3,000 USD per month.

“His mom knows all the biggest real estate developers in the city”

I once dated a girl who had a lot of friends from wealthy families. I went to a Christmas party with her and met some people she knew in the context of being a founder. In conversation it became pretty clear that most of these people wouldn’t even consider starting a business that couldn’t exit for at least tens of millions of dollars. So that is what they spent their time and energy trying to do.

These groups seem different, but the mechanisms underlying their decision-making are the same. Their aspirations with regards to money, and accordingly, how they spend most of their time, are the result of circumstances, and the connection between these two things is opaque to them.

It’s like this for most people, but does it have to be? Ideally, you’re the one deciding which glasses you wear.

What to do about this?

The only thing to do here, as far as I can tell, is the original psychoanalytic project of making the unconscious conscious.

What is your own relationship to the objective-subjective nature of money? What seems reasonable or unreasonable, attainable or unattainable, too little, too much, or just enough? For yourself and for other people. I think it’s good to ask ourselves these questions.

Parts work can also be good for this too. Psychedelics and meditation are probably indirectly good for it, as they seem to be for any inward-looking development project.

In lieu of more concrete takeaways, I would also just like you to appreciate the strangeness here, and the different parts of our lives (most, if not all) that it impacts. I had fun riffing on this, I hope you had fun reading it.

Until next time,

Aaron

🕶️ Other cool things (crypto edition)

You are probably aware that we are in a giant crypto bull market. If you’re not, you may be missing out on quite a bit of money. Here are some resources you may find helpful for navigating the space.

🤑 Cryptocurrency Learning & Resources (F&F article)

An introductory post I wrote in 2018, that is (surprisingly, considering how fast crypto moves) still relevant. This serves as a good general overview and introduction to the space.

💰 A Twitter thread of resources for learning about DeFi

DeFi (decentralized finance) has been a bubble within a bubble during this crypto bull run. The concept of recreating the financial system in a decentralized way is pretty fascinating.

Excellent explainer videos for all things DeFi

🌪️ A whirlwind tour of Ethereum finance

A nice writeup on LessWrong about different aspects of DeFi

This is where I’m doing most of my buying and selling of computer coins these days. The UI is very good (trading with leverage on Binance, for example and by comparison, is highly nonintuitive). If you’re signing up, you can use my affiliate link for discounted fees.

Thanks for reading Good Thought! If you enjoyed it, why not subscribe?

© 2021 ✉️Good Thought